Like this post? Help us by sharing it!

After some exciting blog posts in recent times, today I bring you a practical no nonsense bit of travel advice. It’s a little dry but it could save you a lot of money and that has to be a good thing!

Nobody likes paying commission on currency exchange but like death and taxes, this just seems unavoidable! “No commission” usually means a terrible exchange rate and finding the best place to purchase currency can be a time consuming process. However, this can be time well spent as the difference in rates can be substantial and if you are travelling to Japan for two weeks you will be spending a fair bit of yen.

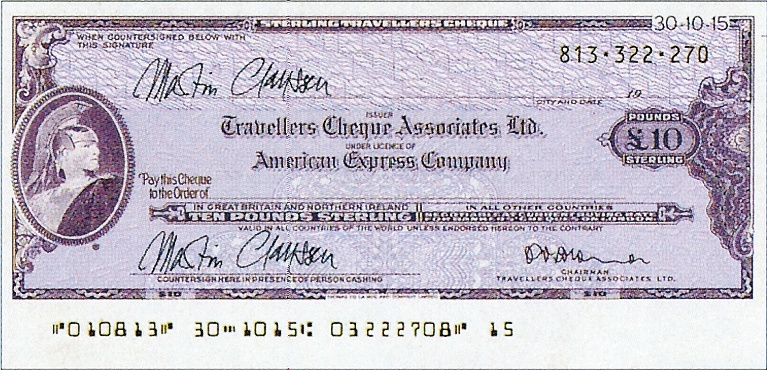

I have often noticed at the airport in Japan that the old stalwart of currency exchange and travel money, the travellers’ cheque, returned by far the best rate on your money. I don’t think I have used traveller’s cheques since a school trip to Italy when I was 14. However, never say never and if this was the way to get more yen for my pundo then all the better. So at Bristol Airport I headed to the Travelex desk to purchase £500.00 of sterling traveller’s cheques. Sadly this was not commission free either with a £3.99 charge but I was prepared to live with that. The spot rate at that moment for yen (current bank to bank FX rate) was £1 = 138.79. Travelex were offering yen cash at a “commission free” rate of 121.8323. Daylight robbery I am sure you’ll agree!

16 hours later I touched down at Narita Airport and headed for the currency exchange desk. As noted on previous visits, for obtaining yen at the airport good old fashioned traveller’s cheques were the currency instrument of the moment!

GBP Cash = 128.09

Traveller’s cheques = 134.85 – Horray!

Result! The spot rate at the time was 139.0444 so Narita Airport was certainly a lot more competitive than Bristol. No great surprise there but my traveller’s cheques had not let me down. I received 67,425 yen for my TC’s which in total had cost me £503.99. So a realised rate of 133.7824. Not bad I thought. The same amount of yen would have cost me £526.38 in cash at Narita Airport and an incredible £553.42 cash at Bristol Airport.

Next I headed for the ATM. All post office ATM’s in Japan accept foreign issued cards as do the ATM’s in 7-11 convenience stores. Being lazy and poorly prepared this is how I have obtained all my currency in the past. So I withdrew 10,000 yen and waited for this to show up on my bank statement, which it did a few days later – withdrawl £74.28, visa charge £2. So a total of £76.28 which makes a realsied rate of 131.096. Still winning with my mighty TC’s I thought! However, I was somewhat miffed to find another visa charge on my statement for my traveller’s cheques!! Outrageous. Visa had added £10.07 to my purchase (no warning of this anywhere). I could have withdrawn the money from an ATM free of charge and then paid in cash if I had known. Grrrrr. So my traveller’s cheques had now cost me £514.06 taking my realised rate down to 131.1617. So basically almost exactly the same as my yen ATM withdrawal at the airport.

The next point of investigation was online purchases and it seems that this is where the best deals are, as so often, to be had. For advice I turned to MoneySavingExpert.com and in particular the travel money calculator – http://travelmoney.moneysavingexpert.com/

An instant calculator will tell you who is going to give you the best deal for your pounds when purchasing those all important yen for your eagerly anticipated Japan adventures. Now, I did not actually place an order (should have done this a couple of weeks before travel) but the quoted rates of some sites were very close to the spot rate – in one case above the spot rate which made me instantly suspicious. As they say every episode on The Real Hustle, if something seems to good to be true, it probably is! However, it does seem that for the more organised amongst you, this is the way forward. At the time of writing (12:55 pm, Japan time, 19th April) the spot rate is 133.952. Here are some example online purchases (cash delivered to your door)

Thomas Exchange: 133,000 JPY for £1,003.93 (includes £5 delivery insurance) = realised rate of 132.4794

Best Foreign Exchange: 134,000 JPY for £1,001.93 (includes £7.50 delivery insurance) = realised rate of 133.7491

Moneycorps: 131,000 JPY for £1,006.76 (includes £7.50 delivery insurance) = realised rate of 130.1204

Of course there are a couple of other things to take into account when choosing who to buy currency from. Firstly, Thomas Exchange and Best Foreign Exchange are not regulated by the FSA (Financial Services Authority) and neither do they accept payment by credit card. If you were to not receive your money for any reason this makes your options for getting your cash back more limited. I have no reason to doubt their reliability but it is worth bearing in mind. Moneycorps on the other hand are regulated by the FSA, accept payment by credit card and carry out an online identity check before allowing you to place an order – a good demonstartion they take fraud and protecting their customers seriously.

Other things to look out for are extra delivery charges for smaller amounts and buy back options (should you not use all the foreign currency you have purchased).

That’s about that for my attempt at the definitive guide to purchasing your holiday yen. My conclusion is really the best rates are to be had online for pre-orders of currency. However, if you are a little disorganised in making your travel plans, then sterling (or USD if you are travelling from the US) traveller’s cheques exchanged at the airport (and I highly recommend exchanging at the airport as the process at Japanese banks can be painful) are probably the best rate available. And finally, if that all seems too much hassle, use the ATM’s at the Post Office and 7-11 convenience stores to get your hands on all the yen you need – just be sure to tell your card issuer you will be travelling to Japan or the withdrawal will be blocked by your bank for security reasons.

Hopefully you will find this useful and by shopping around you will have some extras yens in your pocket to spend on all those marvellous goodies available in Japan!!